Bookkeeping is the organised way of recording and tracking the money that enters and leaves a business. It keeps the financial life of a company steady and clear. When owners understand what bookkeeping is, they gain stronger control over spending, income, and legal responsibilities. In Australia, where tax laws are strict, bookkeeping keeps every business safe and ready for inspections.

Many business owners feel overwhelmed when they see numbers, tax forms, or bank statements.

Bookkeeping brings order to these challenges and offers a clear view of daily operations. With proper bookkeeping, records remain accurate, and the company stays ready for crucial decisions.

Why Bookkeeping Matters For Businesses?

Bookkeeping is necessary as it insulates the business against confusion, missing data and tax issues. It allows for more effective planning and studying of the financial course in the company.

By maintaining up-to-date records, business owners learn trends, know what is strong and where to find areas of weakness that need improvement. This is why many small businesses opt for bookkeeping services that help maintain strong and accurate records.

Most Australian small businesses face cash flow issues due to untracked weekly spending, not low sales. Maintaining bookkeeping helps identify late payments, increased supplier costs, and wasted subscriptions before they impact cash flow.

How Bookkeeping Works Each Day?

Bookkeeping follows a simple principle: record every financial activity in a clear and structured manner. These records help owners, accountants, and tax professionals understand how the business is progressing.

Important Parts of Bookkeeping

1. Recording Daily Transactions

This includes recording sales, bills, receipts, wages, and every form of payment. Accurate entries help prevent errors during tax time.

2. Bank Reconciliation

This is a process that involves the comparison of business records with bank statements. When a number is not identical, the bookkeeper looks and finds the missing part and updates the record.

3. Accounts Payable and Accounts Receivable

These records indicate who should pay and who should be paid by the business. It helps in better cash flow planning.

4. Payroll Management

5. GST Tracking

The GST regulations maintain a close monitoring of the GST on sales and GST paid on purchases. These details are maintained by the bookkeeper for

BAS lodgement.

Manual Bookkeeping and Cloud Bookkeeping

Bookkeeping was performed using notebooks and spreadsheets. Such an approach was more attentive and prone to errors. A lot of small businesses today utilise cloud systems, including Xero, MYOB, and QuickBooks. These tools provide:

- Quick updates

- Safer storage

- Real-time access from many locations

Cloud platforms support both

accountancy and bookkeeping tasks, allowing smoother management of financial work.

Why Do Small Businesses Benefit From Bookkeeping Services?

Small business owners often juggle multiple responsibilities. Bookkeeping services alleviate the burden of managing finances and establish a reliable financial system.

1. Support With Australian Tax Rules

The Australian Taxation Office requires clear and accurate records. Bookkeeping supports rules related to:

- GST

- BAS lodgement

- Superannuation reporting

Accurate records reduce the risk of errors and audits.

2. Easier Tax Preparation

The end of the tax year is easier when the numbers are maintained throughout the year. Bookkeepers manage information in such a way that accountants can prepare tax statements without being stressed.

3. Clearer Understanding of Cash Flow

The cash flow indicates how money flows in the business. Bookkeeping assists owners in viewing the high expenditure times, low-income times, and the future financial requirements.

4. Stronger Decision Making

Effective bookkeeping produces trustworthy reports. These reports enable owners to plan budgets, set goals, and make decisions confidently.

Bookkeeping vs Accounting

|

Feature

|

Bookkeeping

|

Accounting

|

| Main Purpose |

Recording daily activity |

Studying financial data |

| Focus |

Tracking income and expenses |

Creating reports and plans |

| Tools |

Xero, MYOB, QuickBooks |

Tax and planning software |

| Outcome |

Clean financial records |

Financial statements and strategies |

How Bookkeeping Supports GST And BAS Lodgement?

GST laws require careful records of taxable sales and business purchases. A bookkeeper tracks this information every week or every month. When the

Business Activity Statements lodgement time arrives, the bookkeeper prepares the required numbers and checks for accuracy.

This process reduces mistakes and protects the business from penalties. Businesses that stay organised build trust with employees, customers, banks, and the ATO.

DIY Bookkeeping Or Professional Bookkeeping Service

Some small business owners choose to record their own numbers. This works for very simple operations, but mistakes often grow over time and create stress at the end of the year.

Many professional bookkeepers operate as a

registered BAS agent, regulated by the Tax Practitioners Board (TPB). A professional bookkeeping service offers support such as:

- Accurate records

- Timely BAS lodgement

- Clean payroll reporting

- Strong GST tracking

- Regular account checks

Professional services help owners focus on customers and growth instead of paperwork.

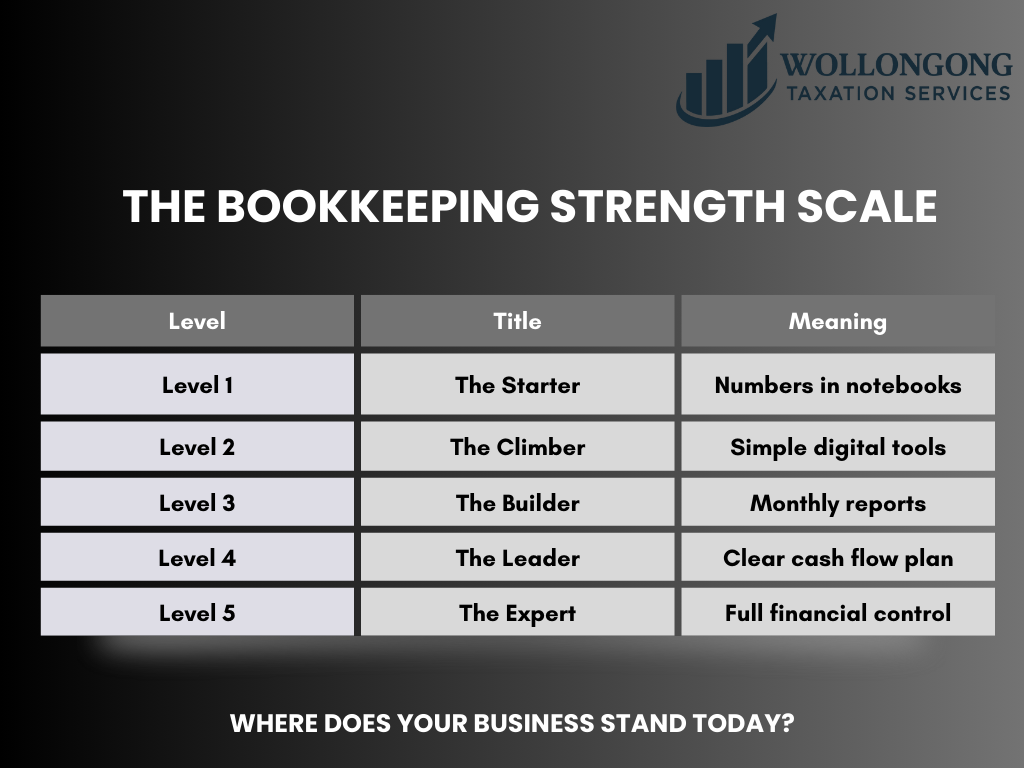

The Bookkeeping Strength Scale

How To Choose The Right Bookkeeping Service?

The best bookkeeping service shows a strong understanding of Australian laws and uses modern technology that keeps financial information safe.

Experience and Industry Knowledge

The bookkeeper should understand different business types and their financial requirements.

Use of Cloud Tools

Cloud platforms allow safer storage, quick updates, and simple access for both owners and accountants.

Flexible Services

A good service adjusts to the size and level of activity of the business.

Good Value

The goal is strong support and accuracy, not simply the lowest price.

Benefits Of A Clean And Organised Bookkeeping System

A robust bookkeeping system creates stability within the business. It shows exactly where money moves and how the company is performing. Key benefits include:

- Better understanding of profits and losses

- Less complicated budgeting of the future.

- Better payroll and employee records.

- Accurate information for tax reports

These benefits help business owners stay confident, informed, and ready for future growth.

Final Words

Bookkeeping is the backbone of sound financial management. It shields Australian businesses from errors, confusion, and legal troubles. It reveals a clear view of income, expenses, and long-term direction. With proper organisation and effective support, bookkeeping becomes a tool for growth and resilience. Business owners who adopt modern systems and expert guidance shape stronger futures and develop lasting financial habits.

For reliable support, consider

Wollongong tax services, which provides information for Australian individuals and businesses.

FAQs

What Is Bookkeeping In Simple Words?

Bookkeeping is the organised way of recording money that enters and leaves a business. It helps keep financial information clean and easy to understand.

Why Is Bookkeeping Important For Small Businesses?

It supports tax preparation, cash flow tracking, and legal compliance. It also helps owners understand how their business is performing.

What Makes Bookkeeping Different From Accounting?

Bookkeeping records daily activity. Accounting uses these records to create reports, budgets, and tax plans.

How Often Should Bookkeeping Be Completed?

Most businesses update their records every day or every week. Frequent updates reduce errors and confusion.

What Services Do Bookkeepers Provide?

Bookkeepers record transactions, manage payroll, track GST, complete bank reconciliations, and prepare information for BAS and tax reports.