Lodging a Company Tax Return is one of the most important duties for every Australian business, no matter the size or industry. An accurate return helps your business show real strength because it proves that your records are honest and your numbers are correct. A clear return also protects your business from trouble with the ATO, such as interest charges or strict penalties.

This guide explains the process in plain language, making every step easier to follow. You will learn which form to use, how to understand the instructions, and the deadline that applies in 2025. With the right preparation, your annual return becomes a clear picture of financial health and long-term growth.

Why Does Your Company’s Tax Return Matter More Than You Think?

A company tax return is far more than a yearly form. It provides a comprehensive record of the business performance over the twelve months. Banks study it when you apply for credit. Investors check it before they invest their funds. Buyers request it before purchasing your business. A clear tax return builds trust and stability.

The ATO also depends on your return to shape your future tax path. The information inside your return influences PAYG instalments and limits on GST refunds. When your records stay accurate, the tax office treats your business as low risk.

A strong lodgement history has long-term benefits. A company that keeps a clean record is less likely to face audit activity for up to five years. This protects your time, your books, and your peace of mind.

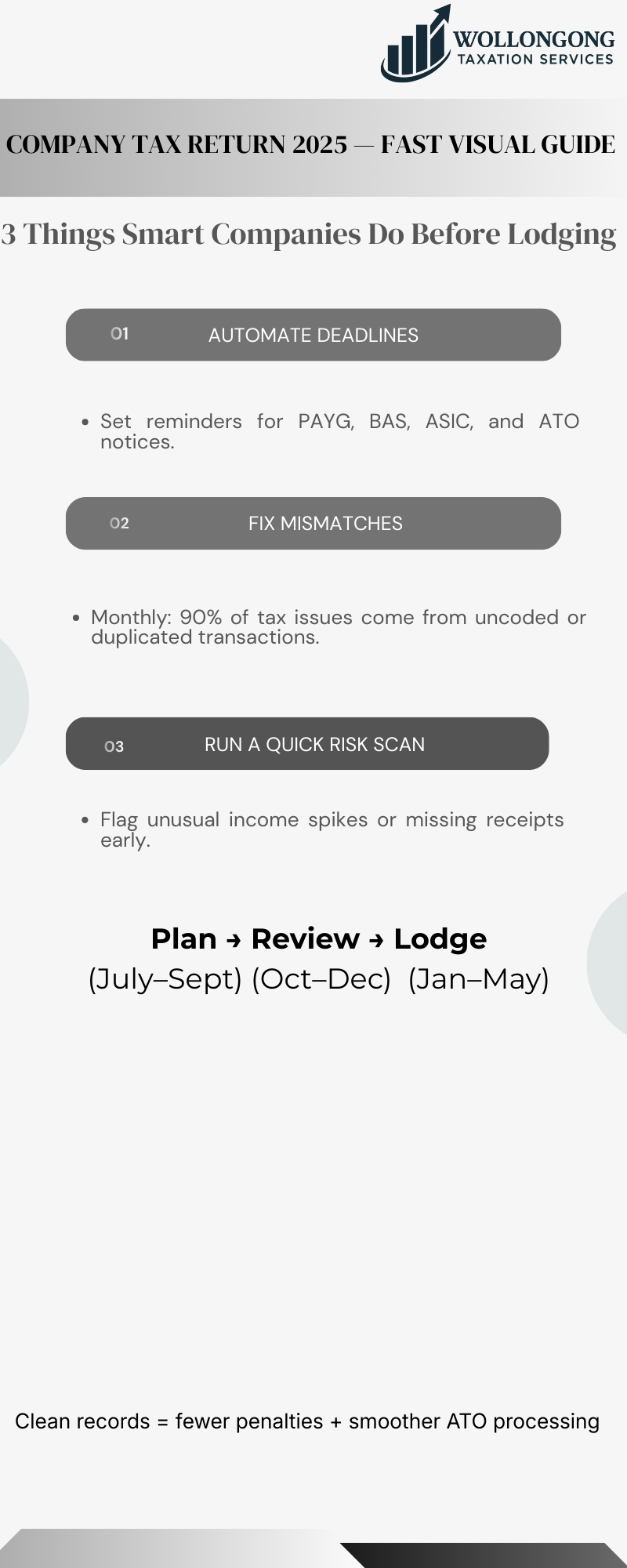

Company Tax Return 2025 — Fast Visual Guide

Company Tax Return ATO Overview — Who Must Lodge?

Which entities?

Many business structures fall under the ATO company return rules. These include:

- Private companies (Pty Ltd)

- Public companies

- Unit trusts that the ATO classifies as companies

- Non-profit organisations that still hold taxable income

Every listed structure must submit a return even when no profit exists for the year. The ATO views the return as a compulsory annual report, not an optional task.

Which form?

You must select the correct return form, or the lodgement may fail:

- Form C: The standard ATO company tax return form for almost all companies

- Form T: Used by trustees of corporate unit trusts

These forms enable the ATO to compare details across thousands of businesses, so accuracy at this stage is important.

2025 Company Tax Return Deadline Calendar

| Deadline Type | Date |

| Financial year-end | 30 June 2025 |

| Self-lodgement | 31 October 2025 |

| Tax-agent lodgement | Up to 15 May 2026* |

The exact date depends on your agent’s ATO lodgement program.

Meeting each deadline is essential because the ATO closely monitors late returns. Late lodgement often leads to warning letters, penalty units, and interest charges.

Step-by-Step Company Tax Return Instructions

These steps guide you through the full lodgement process clearly and steadily. Each stage helps your business build accurate records and avoid errors that may lead to trouble later.

1. Gather Core Documents

A strong tax return begins with complete financial records. Prepare the following documents:

- Final profit and loss statement

- Balance sheet

- Cash flow statement

- General ledger with correct tax codes

- Capital gains worksheets

- Prior-year company income tax return and Notice of Assessment

These documents help you reduce errors because every label in the return links back to one of these reports.

2. Check Eligibility For The 25 Per cent Tax Rate

Australia offers a lower 25 per cent tax rate for base rate entities. To qualify, a company must pass two tests:

- Aggregated turnover less than fifty million dollars

- No more than eighty per cent of income from passive sources, such as rent, royalties, or interest

If your turnover rises or if passive income becomes too high, the company may lose the lower rate for the year. Testing these factors early helps you plan business decisions before the end of June.

3. Complete The ATO Form

Form completion requires careful reading of ATO labels. You may use SBR-enabled software or the ATO online service. Both methods help the office scan your data.

Important labels include:

- T1 – Total revenue

- T2 – Total expenses

- T3 – Taxable income

- T5 – Tax on taxable income

Each label must match your financial statements. For example, the revenue number in T1 must equal the revenue figure on your profit and loss statement. Mismatches may trigger ATO questions later.

4. Review And Lodge

Before lodging, review every detail. Reconcile all PAYG instalments already paid through label K. If your business took part in R&D, sold assets with capital gains, or held complex financing arrangements, attach the correct schedules, such as R&D, CGT, or thin capitalisation.

Electronic lodgement offers faster processing, usually around fourteen days. It also reduces errors because digital systems highlight missing fields before submission.

Common Mistakes That Trigger ATO Audits

Even small mistakes may attract unwanted attention from the tax office. Below are the most common errors:

- Misclassifying passive income and losing the 25 per cent tax rate

- Treating personal purchases as business costs, which may create a Division 7A breach

- Failing to report JobMaker or older COVID grants as assessable income

- Missing the company tax return deadline, which leads to penalties starting from two hundred twenty-two dollars and rising each week

Understanding these mistakes helps you prevent future issues.

Pro Tips To Streamline Next Year’s Lodgement

Preparing for next year begins the moment this year comes to a close. Use the tips below for smoother lodgement:

- Use cloud accounting platforms that map tax codes automatically

- Reconcile BAS and bank feeds every month to avoid year-end stress

- Run franking account previews every quarter, so dividends stay fully franked

- Lock your records on 31 July, so you have three months to check errors before the agent begins work

These habits help you keep books clean and ready for submission long before the deadline approaches.

Conclusion

Follow these company tax return instructions, mark the company tax return deadline in your calendar, and download the correct company tax return form from the ATO today. Preparation during the year protects you from penalties, interest charges, and stressful nights later. With clear organisation, your company income tax return becomes a strong and reliable snapshot of your business health for investors, banks, and future opportunities.

Contact Wollongong Tax Services today and give your business the support it deserves. Book your appointment now and move forward with clear and confident tax guidance.

Also Read:

Partnership Tax Return 2025: A Complete Guide

2025 ATO Guidance For Employers: Simple Tax & Tips For Apprentices

FAQs

May I Lodge My Own Company Tax Return, Or Must I Hire An Agent?

Yes, self-lodgement is possible for small companies. However, you must meet the 31 October deadline and use SBR-approved software to submit data through the system.

What Happens If I Miss The Company Tax Return Deadline?

The ATO issues a failure-to-lodge penalty. Interest then grows daily through the General Interest Charge until the amount is paid in full.

Is the 25 %Tax Rate Automatic?

No. A company must satisfy both the turnover test and the eighty per cent passive income test each year. A quick review before 30 June protects the business from surprises.

Do I still need to Lodge If The Company made a Loss?

Yes. Losses must appear in the return so the business offsets them against future profits.

How long should I keep supporting documents?

Hold digital copies for at least five years. The ATO may review any of these periods during audit activity.