Payday super is one of the most significant changes to Australia’s super system in decades. From 1 July 2026, businesses will be required to pay super at the same time as employee wages, replacing the current quarterly payment system.

For employers, payroll managers, and HR teams, this reform affects cash flow, payroll systems, compliance processes, and reporting obligations. This guide explains what payday super means in practice, why it is being introduced, and how employers can prepare for the 2026 start date.

What Is Payday Superannuation?

Payday superannuation requires employers to pay Superannuation Guarantee (SG) contributions at the same time as salary and wages, rather than quarterly. According to the Australian Treasury, the reform ensures super is paid “as wages are earned,” reducing underpayment and unpaid super.

Under current law, employers can pay SG up to four times a year. From 1 July 2026, super must be paid on or before each payday, regardless of whether wages are paid weekly, fortnightly, or monthly. This means weekly payroll requires weekly super payments, fortnightly payroll requires fortnightly super payments, and monthly payroll requires monthly superannuation payments.

Why the Government Is Introducing Payday Super

Addressing Unpaid and Late Super

The main driver behind Payday Super changes is protecting employee entitlements. Research published by the Australian Taxation Office shows that unpaid super remains one of the largest forms of wage theft, particularly affecting younger workers and casual employees. The ATO estimates a net super guarantee gap of around $6.2 billion or 6% of the estimated theoretical SG liability for 2022-23.

Treasury modelling indicates that payday super could significantly reduce non-compliance by aligning super payments with existing payroll processes rather than quarterly reporting cycles.

Improving Retirement Outcomes

According to Payday Super Treasury analysis, earlier and more frequent super payments can materially improve retirement balances due to compounding returns over time. By switching to a payday super, a 25-year-old median income earner currently receiving their super quarterly could be around $6,000 or 1.5 per cent better off at retirement.

Real-Time Reporting and Enforcement

With Single Touch Payroll already in place, the ATO has better visibility over wages. Payday superannuation builds on this system by making super payments easier to track and enforce through real-time data matching.

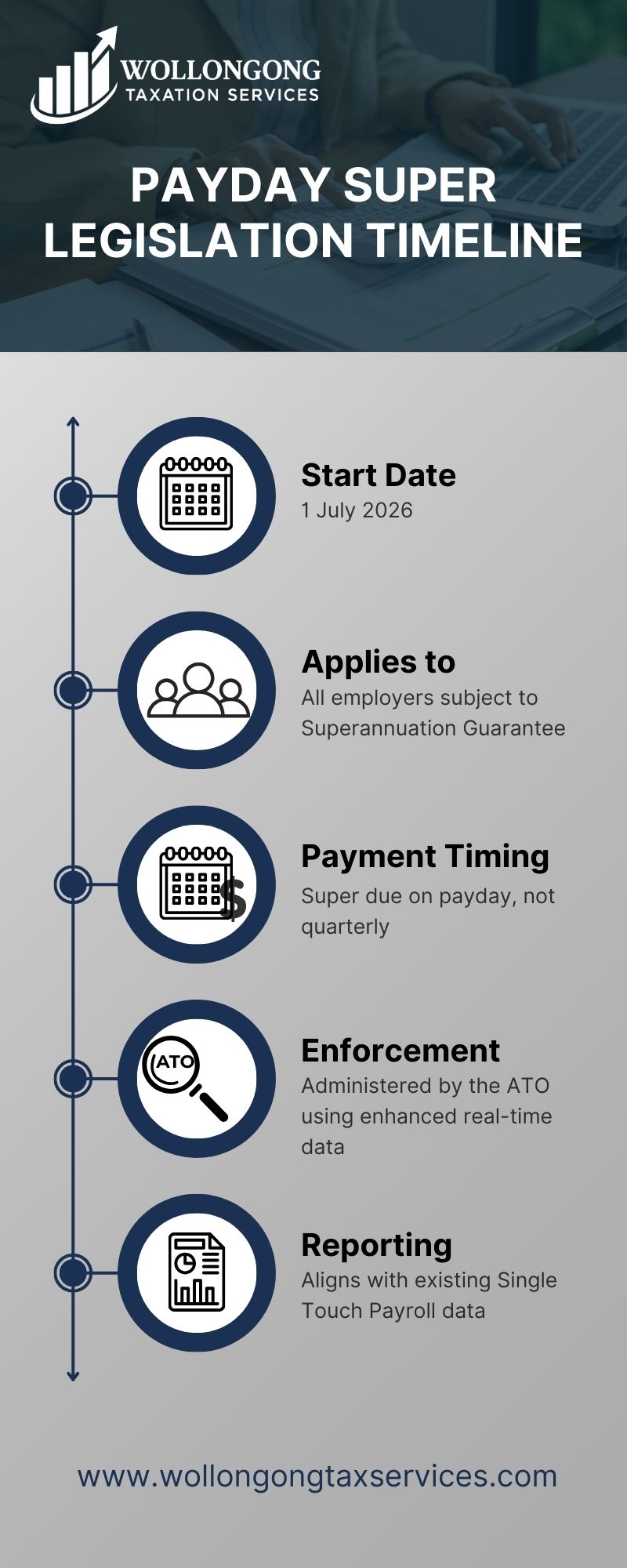

Payday Super Legislation Timeline

It was announced in the 2023–24 Federal Budget and is being implemented through amendments to superannuation and taxation legislation. The Payday super legislation, specifically the Treasury Laws Amendment (Payday Superannuation) Bill 2025 and related legislation, has now passed parliament.

Key confirmed details include:

The ATO has released information confirming that ATO Payday Super 2026 will apply to employers across Australia, including small and medium businesses. The intention is not to increase super rates, but to change when super is paid.

How Payday Super Will Work

Payment Timing

According to ATO guidance, employers must ensure that superannuation payments reach the employee’s fund on or before payday. This shifts super from a deferred obligation to a real-time payroll responsibility. The biggest change is the removal of quarterly payment deadlines. Super must be paid at the same time as wages, not weeks or months later.

Clearing Houses and Processing Delays

Industry bodies have noted that payment processing times will be critical. Employers may need to submit super earlier than payday to account for clearing house delays. This operational change may be the biggest adjustment for small businesses.

ATO Compliance Requirements

The ATO will enforce payday super compliance closely. Employers must ensure that super contributions are paid on time with each pay run. Late or missed payments may attract penalties, with closer monitoring due to real-time payroll reporting. The ATO expects accurate reporting through Single Touch Payroll. Every super payment should be reconciled with wages, and any adjustments must be documented promptly.

Penalties for Late Payment

ATO guidance indicates that late payments may trigger Superannuation Guarantee Charge liabilities. The SGC includes the super guarantee shortfall, nominal interest of 10% per annum, and an administration fee of $20 per employee per quarter. Employers who miss payments face financial penalties and interest charges.

Repeated non-compliance can lead to increased scrutiny and audits. Directors and senior managers may be held personally liable for unpaid super through director penalty notices.

Record-Keeping Requirements

Employers must maintain clear records of super payments for each employee, including payroll data showing gross wages and super calculations, confirmation of payments to employee super funds, and documentation for any corrections or adjustments. With payday super aligned to payroll, the ATO can more easily identify discrepancies.

Payroll Software Updates

Major payroll software providers have confirmed they are updating systems to support payday super. Payday super Xero and Payday super MYOB integrations will be available, as these systems integrate Payday super into existing payroll workflows, leveraging automated super calculations and STP reporting to reduce manual steps. Employers can set up payment schedules that align with each pay run, with detailed reports showing super contributions per employee.

While software will handle calculations, professional bodies stress that employers remain legally responsible for correct and timely payments.

Current Quarterly Super vs Payday Super 2026: Key Differences

| Aspect | Quarterly Super (Current System) | Payday Super (From 1 July 2026) |

| Payment timing | Paid every 3 months | Paid every payday |

| Compliance risk | Higher risk due to delayed reporting and visibility | Lower risk with real-time reporting |

| Cash flow impact | Large lump sum payments | Payments are spread across each pay cycle |

| Payroll complexity | Lower, simpler payroll setup | Higher initially due to system changes |

| ATO monitoring | Limited, after-the-fact checks | Real-time ATO monitoring |

Preparation Steps for Employers

Based on professional guidelines and regulator advice, employers should consider the following well before July 2026:

Review bookkeeping and payroll software capabilities and update systems early. Understand clearing house processing times to avoid late payments. Consult with accountants or bookkeepers to discuss the cash flow impacts. Monitor Treasury and ATO updates for final legislative details. Train payroll staff on new payment schedules and reporting requirements.

Cash Flow Planning

Employers should forecast payroll and super obligations for each pay period, adjust budgeting to accommodate weekly or fortnightly contributions, and consider setting aside super funds in advance to avoid late payments. By planning, businesses can effectively manage their cash flow and stay compliant.

Who Will Be Most Affected

Small and medium businesses, especially those with tight cash flow or variable payroll schedules, will need to adjust their processes. Employers who currently pay super quarterly will face the biggest change. Businesses with casual, part-time, or seasonal employees will need to update payroll systems to calculate and pay super for each pay run accurately.

Companies already using automated payroll software may find the transition smoother, though proper setup and training remain essential. For sole traders and partnerships with employees, understanding these new obligations is important for staying compliant.

Conclusion

Payday super represents a significant change in how Australian employers handle superannuation. From 1 July 2026, super contributions must be paid alongside wages, making compliance a key responsibility for all businesses.

Early preparation is essential. Updating payroll systems, reviewing cash flow, consulting with professional advisers, and training staff can prevent errors and avoid penalties. By understanding the legislation and following ATO guidance, employers can ensure payday super is implemented smoothly, and employees receive their entitlements on time. Taking payday super seriously and establishing robust payroll and payment systems is the best way to avoid risks and ensure smooth compliance in 2026.

Need help preparing your business for payday super? Contact Wollongong Tax Services for expert guidance on payroll compliance and superannuation obligations.

Related Articles

Tax Laws in Australia: Guide for Residents & Non-Residents

ATO BAS Lodgement Guide: How to File Accurately and Avoid Penalties

FAQs

Do small businesses have to comply?

Yes. Payday Super applies to all employers subject to the Superannuation Guarantee, regardless of size. No permanent small business exemption has been announced.

Will the super rate change?

No. Payday super changes payment timing, not contribution rates. The Superannuation Guarantee rate remains unchanged.

When do the rules start?

The new rules take effect from 1 July 2026, meaning all super payments must align with each pay run from that date.

What happens if a super is paid late?

Late payments attract ATO penalties through the Super Guarantee Charge, including interest charges and potential director liability. Maintaining accurate records and timely payments is essential to avoid these risks.