Understanding the tax‑free threshold in Australia is essential for every Australian worker and newly arrived professional in 2026. It determines how much you can earn before you start paying income tax. Whether you’re a student juggling part‑time work, a casual employee, or a full‑time professional, knowing how to correctly claim and apply this threshold can improve your take‑home pay and help you stay compliant with tax withholding rules.

This article breaks down what the threshold is, who qualifies, how to claim it using your Tax File Number declaration, and what happens if you have more than one job. We’ll also look at how PAYG withholding interacts with your income, why claiming incorrectly can lead to a tax bill later, and how offsets such as the Low Income Tax Offset (LITO) can effectively raise the point before you pay income tax.

What is the Tax‑Free Threshold?

The tax‑free threshold in Australia for the Income tax threshold 2026 is $18,200. If you are an Australian resident for tax purposes, you won’t pay income tax on the first $18,200 you earn in the financial year. This is central to Australia’s progressive tax system, where tax rates increase in the income tax brackets as your taxable income grows. Key points:

- The threshold applies before any tax is withheld.

- Your employer uses your Tax File Number (TFN) and declaration to decide how much tax to withhold.

- Claiming the threshold reduces PAYG withholding during the year.

This system helps people on lower incomes keep more of their money during the year rather than waiting for refunds when lodging Personal tax returns.

What Are the Benefits of the Tax‑Free Threshold?

Here’s how the tax‑free threshold helps most workers:

- Lower upfront tax: Students and part‑time workers don’t pay income tax on the first $18,200 they earn.

- Higher take‑home pay: Claiming the threshold at your primary job means less tax is withheld each pay cycle.

- More predictable cash flow: You have more regular income in hand, rather than a larger refund at tax time.

This is especially useful for:

- Tax‑free threshold for part‑time workers

- Casual staff

- People with irregular hours

Claiming the threshold properly ties into payroll tax rules and can affect how the Low Income Tax Offset (LITO) applies.

How Do Tax Rates Differ by Residency Status?

Your residency status for tax purposes directly affects how much income tax you pay in Australia. Understanding the difference is essential, especially if you are a new resident, an expatriate, or planning to work here temporarily. The tax-free threshold of $18,200 only applies to Australian residents, so foreign residents are taxed differently from the first dollar they earn.

| Feature | Australian Resident | Foreign Resident |

| Eligibility for Tax-Free Threshold | Yes, up to $18,200 | No |

| PAYG Withholding | Reduced tax withheld if threshold claimed | Tax withheld from the first dollar |

| Progressive Tax Rates | Apply above $18,200 | Higher starting rates; no threshold |

| Low Income Tax Offset (LITO) | Applies | Does not apply |

| Medicare Levy | 2% on taxable income above certain thresholds | Not applicable |

Australian residents benefit from the tax-free threshold, which allows them to keep more of their earnings upfront and pay tax only once their income exceeds $18,200.

Foreign residents and expatriates are generally taxed on their first dollar at foreign resident tax rates. This table provides a clear comparison to help you identify your tax obligations and plan your finances effectively.

Who is Eligible for the Tax‑Free Threshold?

Full‑Year Australian Residents

To get the full $18,200, you must be an Australian resident for tax purposes for the entire year. The ATO uses tests based on your living situation and ties to Australia to decide your status. Most students and long‑term residents qualify if they live and work here during the year.

Part‑Year Residents (Pro‑Rata Tax‑Free Threshold)

If you arrive or leave partway through a financial year, you may get a pro‑rata tax‑free threshold. This means a base portion plus an additional amount based on how many months you were a resident. For example, if you arrive mid‑year, your eligible threshold is adjusted proportionally.

Foreign Residents and Expats

Non‑residents for tax purposes generally cannot claim the Australian threshold. They are taxed from the first dollar at Foreign resident tax rates in Australia, which differ from resident rates and usually start at 30%.

Temporary visa holders may have different rules; for example, working holiday makers are taxed at special rates instead of claiming the standard threshold. Always check the ATO guidance or with a registered tax agent if your situation is anything other than straightforward.

How Do You Claim the Tax‑Free Threshold?

Completing the TFN Declaration

When starting a job, your employer gives you a Tax File Number (TFN) declaration form. Look for the question about:

- How to claim tax‑free threshold

- Most often this is Question 8 or Question 9

Answer “Yes” if this is your main job and you intend to claim the threshold. If it’s a secondary job, answer “No” to avoid under‑withholding.

When Should You Submit It?

- Submit early in your first pay cycle to ensure correct PAYG withholding.

- If your situation changes (for example, you switch jobs), hand a new form to your employer.

- Keep records of your TFN declaration submissions along with relevant tax return documents.

Using the correct form and timing helps you avoid surprises at tax time when lodging Personal tax returns.

How Does the Threshold Work with Offsets?

The Low Income Tax Offset (LITO) can raise your effective tax‑free point beyond the base $18,200. Most residents don’t pay income tax until close to $22,575, thanks to the offset. This doesn’t change the threshold itself, but it lowers your total tax owed.

- LITO is not a cash rebate; it reduces the tax payable.

- It’s applied when you lodge your return.

Understanding the effective tax‑free threshold with LITO is useful when you use a Take‑home pay calculator Australia to plan your income.

What Are the Upcoming Tax Changes in 2026?

From 1 July 2026, the tax rate on the $18,201–$45,000 bracket will reduce from 16% to 15% under current legislation. These 2026‑27 Australian tax changes aim to cut tax for lower and middle‑income earners. The base tax‑free threshold in Australia, $18,200, is not changing, but moving the rate down means less tax on earnings above the threshold.

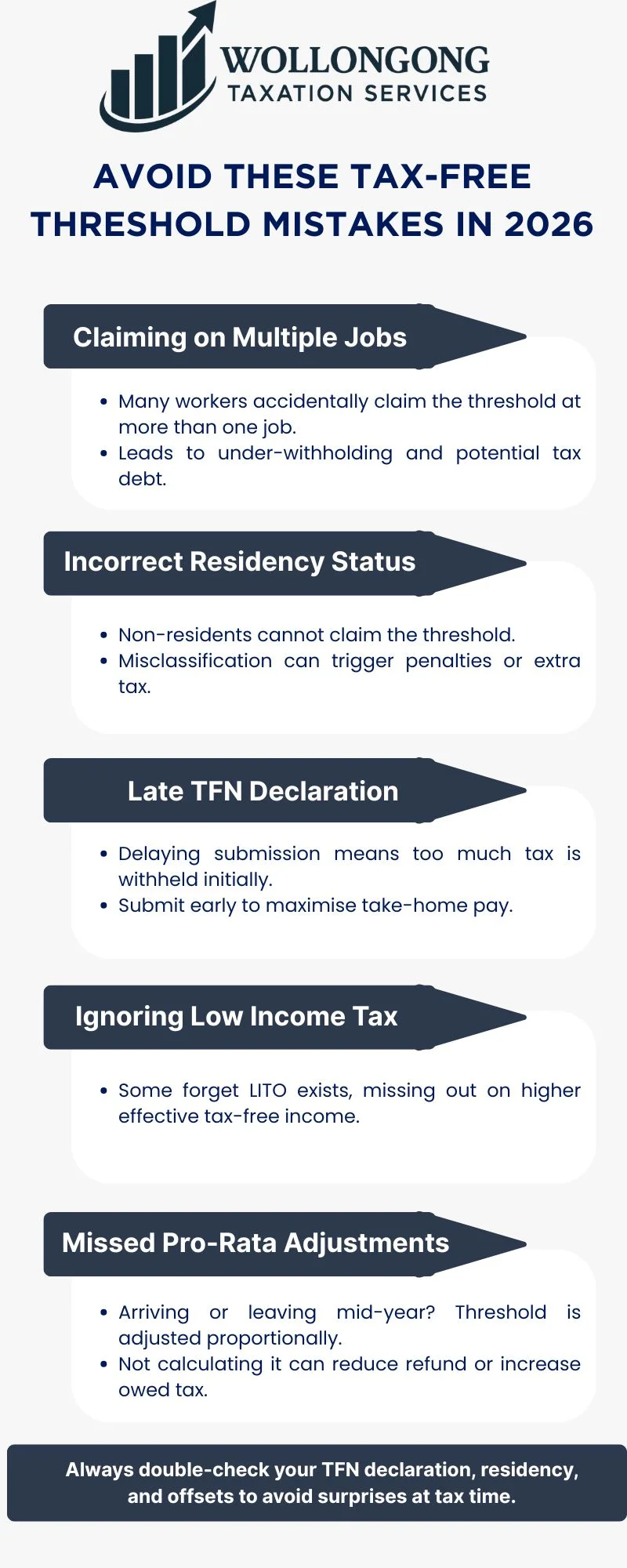

Avoid These Tax-Free Threshold Mistakes in 2026

Conclusion

The Australian tax‑free threshold remains one of the most important elements of your tax profile in 2026. Knowing how to claim it properly with your Tax File Number declaration and manage your PAYG withholding across jobs can make a meaningful difference in your take‑home pay and help you avoid unexpected bills when you lodge your Personal tax returns. Use tools like a Take‑home pay calculator Australia and stay aware of upcoming tax changes.

Get Your Tax Done Right, Every Time

At Wollongong Taxation Services, we make tax and accounting simple and stress‑free for individuals and local businesses. Whether you need a personal tax return lodged, business BAS completed, or ongoing bookkeeping support, our registered tax agents handle it all with clear advice and reliable compliance. Book your appointment to get expert help, maximise your refund, and stay on top of your tax obligations with confidence. make shorter

Related Articles

Tax Laws in Australia: Guide for Residents & Non-Residents

Tax Audit 2026 Guide: Avoid ATO Penalties & Risks

FAQs

Has the tax-free threshold increased for 2026?

No, the tax-free threshold remains at $18,200 for the 2025–26 and 2026–27 financial years. However, thanks to the Low Income Tax Offset (LITO), many individuals may effectively pay no income tax on earnings up to $22,575 for the 2025–26 year.

Do I need to lodge a tax return if I earned less than the threshold?

If no tax was withheld and your income is below the threshold, you might not have to lodge a return, but it’s often wise to check. If tax was withheld, lodging a return lets you claim a refund.

How does the Medicare Levy interact with the tax‑free threshold?

Most residents pay a 2% Medicare levy on taxable income above certain thresholds. The effective tax‑free point including offset, can be higher when you consider the Medicare levy low‑income thresholds.

Can I claim the tax-free threshold from multiple jobs?

Generally, you should only claim the tax-free threshold from one employer (usually the one that pays the highest salary). If you claim it from multiple sources, you may not have enough tax withheld throughout the year, potentially leading to a tax debt when you lodge your return.

Does the threshold apply to unearned income like bank interest?

Yes, all taxable income counts. The threshold and offsets apply when calculating total tax in your return, though withholding on interest or other payments might differ.